As another tumultuous week, both in and out of the markets, draws to a close, I’ve attempted once again to compile a summary of the events, which I hope will give you a degree of clarity. Welcome to this week’s News, Views and Truths.

Let me start this edition with my sincere hope that all readers are faring well. Events within global markets are extreme and there is no way to sugar coat this; would you expect anything other from me? However, wider events, locally and further afield, provide each of us with a different perspective on our individual lives and those of our loved ones. If you take anything away from this week’s ramblings, please take care.

Anyway, back to scheduled service.

There are few things that surprise me in the markets anymore, but this week has absolutely drained me. I genuinely cannot wait for my ritualistic Friday night beer; perhaps you may care to join me in spirit?

As the coronavirus spreads, so does uncertainty across global markets and as you all know, the market abhors uncertainty. This is perhaps the most uncertain event in modern history and as such, the continued market reaction has been reflectively extreme.

The fiscal reactions have been as equally extreme.

With the week beginning with a 10% fall in US markets, the newly appointed Chancellor of the Exchequer, Rishi Sunak, unveiled a £330bn package of stimulus, aiming to provide support for UK businesses to weather the approaching economic storm. The range of measures included tax cuts, millions in grants and mortgage holidays.

The White House then stepped up the intervention by announcing plans to send cheques, directly to American citizens to give them emergency financial aid, while agreeing to purchase up to $1trn (£830bn) corporate bonds. To put these numbers into perspective, the US bank bailout package during the financial crisis of 2008 was worth $700bn. And this is what? Week 2?

And then the newly appointed governor of the Bank of England, Andrew Bailey, announced a cut in UK interest rates to 0.1%, whilst simultaneously announcing a £200bn quantitative easing (QE) plan. To be honest, the interest rate cut, albeit the headline, is not the big talking point. Consumers are very unlikely to take advantage of this newly reduced rate in terms of additional borrowing as uncertainty pervades society at this moment. The consumer is simply not the catalyst at this point.

The main factor is QE. The support the government is giving to the economy and health system will require vastly higher government borrowing. The Bank of England is showing willing to buy government debt and will therefore ensure the market can absorb this additional issuance without undue stress. The right hand is talking to the left, which can only be viewed as positive.

Unless this approach is mirrored across the globe, there is concern that a restricted liquidity event, or “credit crunch” may form in the same way as 2008.

Our clients will be aware of our concerns surrounding fixed income markets over recent days. And we have acted upon these. Although during the recent equity market falls, decisions that we have made in respect of client portfolios, specifically our government bond allocations, have performed very well, this is beginning to change. As liquidity dries up, many investors become forced sellers, with fixed income being the first port of call. With the demand for these assets disappearing, supply floods the market, driving up yields and reducing prices. This is what we are currently seeing; this is why the Bank of England is stepping in as new government bonds inevitably hit the market.

Again, speaking to many clients over recent days on this exact topic, we will continue to watch this environment with the keenest of eyes.

So, to summarise, equities are down, fixed income is starting to go down. What next?

Well, that’s the million-dollar question. For what it’s worth, here is my current thinking:

Recession is inevitable; on a technical basis, an economy enters a recession after two consecutive quarters of negative economic growth. A recession is a business cycle contraction when there is a general decline in economic activity and generally occur when there is a widespread drop in consumer and corporate spending. Uncertainty thrives and decisions are put off to a later date.

However, not all recessions are the same. There are three types; cyclical, structural and event-driven recessions.

A cyclical or structural recession averages out a 58% fall in equity markets. However, I would argue that this inevitable recession is event-driven. These recessions historically see, on average, a 29% fall in equity markets. By the way, if you didn’t know, equities are down that already.

Why do I say that we are heading towards an event-driven recession? Well first of all, it’s kinda in the name, “event-driven”. Three weeks ago, markets were extremely buoyant; PE ratios (Price to Earnings ratio) were fine without any real overinflated valuations in the market. There were no structural issues within the economy, with the financial system and the banks in particular remaining very robust. In that way, we have come into this recession with a very different backdrop to 2000 where valuations were extremely stretched and in 2008 when we had serious structural issues with massive levels of over financing.

Now, let’s be honest, the previous quarter earnings projections are a write-off, based upon the current socio-economic uncertainty. However, because of the type of recession that I personally believe that we are heading towards, the recovery should be quick and to be honest, the market is already pricing this fact in.

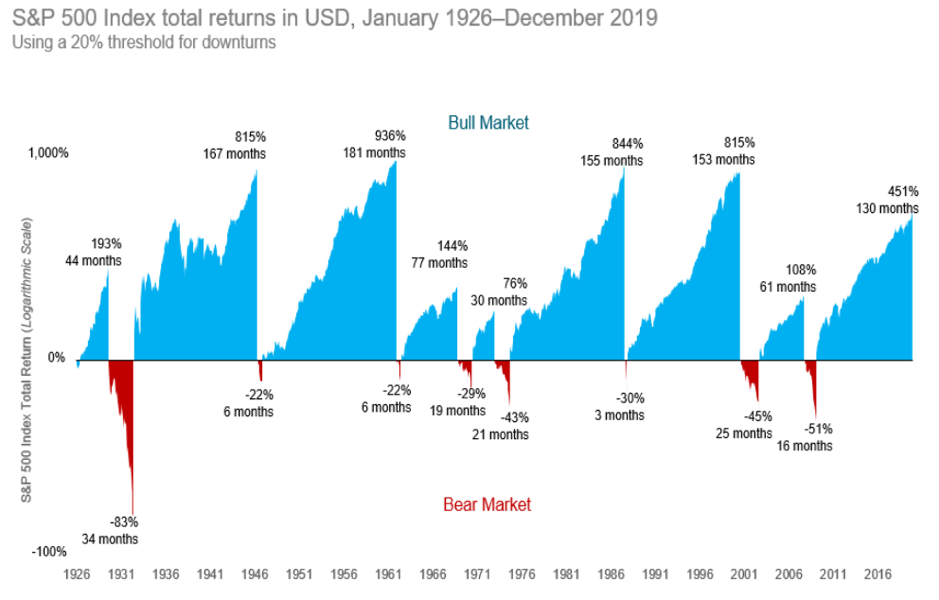

So, what are your actions? My advice would be to keep a long-term perspective. If you are planning to time any re-entry, a quicker than average rebound will certainly put pay to that and if you get this wrong, you will miss out on one of the potentially greatest market recoveries ever. And what could that look like?

I’d like to be the blue line, please. Are you with me?

My final words mirror my opening; please take care. It is very easy to dismiss the current events as insignificant, yet they are clearly not. If there is anything myself or any of my colleagues can do to assist you, please do not hesitate to contact us. Have the best weekend that you can and I shall see you all next week.

- To read our latest statement regarding client support during the COVID-19 pandemic, please visit our blog here.