Hello everyone and welcome to the gateway for your bank holiday weekend. Grab your pots and pans, stand at your front door, clap like your life depends on it and celebrate the institution that is News, Views and Truths.

In the last couple of weeks, I find myself studying the market at a greater level than I have done in my career. Whether this is due to the circumstance of home working that allows me the headspace to do this or because the current scenario is another of those career defining moments. I’d suggest it’s most likely a beautiful combination of the two.

The markets are broken.

Sorry, that’s wrong. The US Equity market is broken.

I watched The Big Short last night – if you take any single piece of information away from this week, go on Netflix and watch it. You do not need to be interested in the market to enjoy the film. I do not think that I am giving any spoilers away when I tell you that the film is about the 2008 Global Financial Crisis (GFC), predicated upon the collapse of the US housing market.

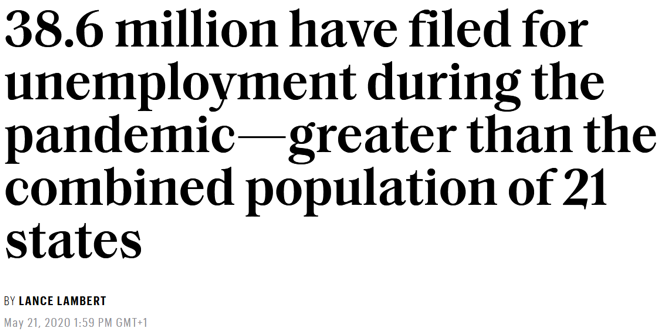

At the end of the film, in sombre, black screen terms, the numerical fallout of the market collapse was detailed, albeit at a high level, to the audience. The biggest numbers, for artistic effect, were delivered last; 8 million US citizens became unemployed as a result of the collapse. Shock and awe tactics. Classic filmmaking.

8 million unemployed. Big numbers. The numbers to end a big film, called The Big Short, about the biggest economic collapse since the last biggest economic collapse. Big.

Until it becomes tiny.

Source: Fortune.com

Yet, the US equity market keeps on trucking higher and higher. The S&P 500 is up 4.19% this week so far and the Nasdaq is up 5.03%; who knows where they will end the week. But to place these returns against the context of current unemployment figures is frankly perverse.

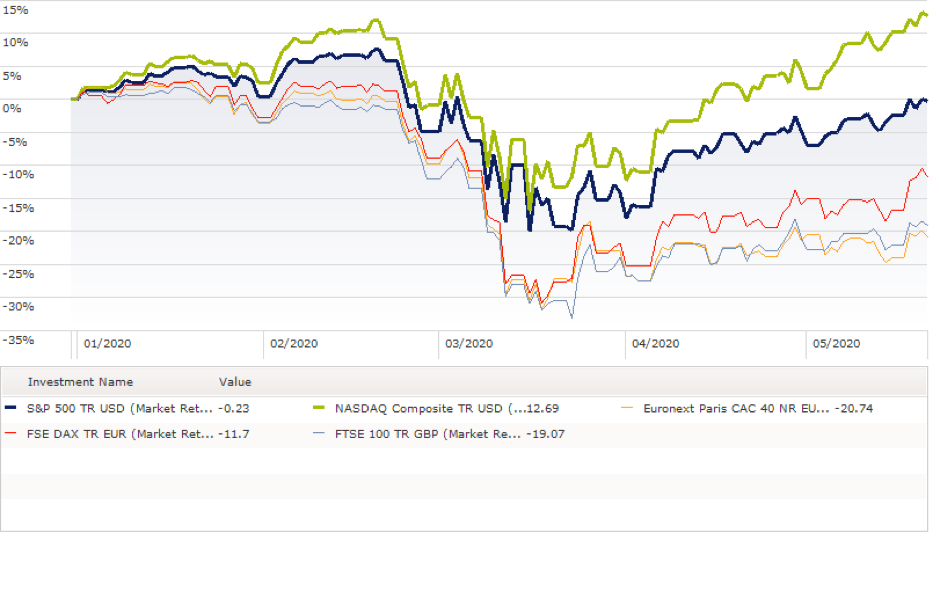

However, this is not repeating across other developed markets. The UK and the European indices are trailing the US significantly during 2020 as detailed in the chart below.

Source: Morningstar

So why? Well, in the case of the Nasdaq, this has been powered by the success of the technologically driven stock listed on it, as these have benefitted greatly within the new paradigm of working from home. Whether this is Amazon delivering goods, or Microsoft and Apple who provide the hardware to allow office workers access to their usual workstations. Intel and NVIDIA who provide PC components or Cisco Systems with the connectivity required to keep data moving. Even stocks directly involved within the search for a cure; regular readers will have heard recently the name Gilead Sciences who are currently in the process of developing a vaccine for COVID-19. Hopefully.

The Nasdaq has risen hugely as a result of the success of its component parts. And perhaps this is understandable. But the S&P500 perhaps less so.

At first glance, the largest components of the index are very similar to the Nasdaq; Microsoft, Apple, Amazon, Facebook, Alphabet (Google). Therefore, this accounts for some of the rises. But further down the list you go, the returns from other names become less justifiable. McDonalds, Yum Brands, Boeing. Companies, all of which have been locked down like the rest of us and therefore unable to trade. Restaurant chains, cruise lines, holiday companies. All entirely understandable.

Yet despite this, the US market ignores reality, prices in a perfect economic recovery and surges ahead.

It is because the US equity market is broken. And the Fed broke it.

If you haven’t done so already, read last week’s blog as it’s a prelude to this one. It gives you all the technical and numerical background to the above statement; how much the Fed have pumped in and in my view, the desperate measures they are undertaking and will continue to do so, in my eyes.

And this desperation is spreading to the US financial media; perhaps unconsciously this has become my personal barometer. Tune in to CNBC and you will see a host of permabulls, advocating the constant investment into stocks, berating the low yields on bonds and praying at the holy altar of the Federal Reserve to “do more”. All of this without any technical guidance aside from blind hope. The actual reverse of the “End is Nigh” guy.

The common phrase used is “Don’t fight the Fed”. That may well be true and it certainly is playing out that way in today’s market. But it doesn’t mean you have to like the Fed.

To conclude, if you haven’t seen it, my latest video on UK equities is HERE. If you haven’t watched it, I’d recommend you to do so; Margaret Lawson, who I interview in the video, is an absolute star and someone you need to listen to if you have exposure to the UK market. Which you all do.

Next week’s video will be going out on Tuesday in its regular spot, the discussion topic being Japan and what the west can learn from an economy that has worked within a deflationary environment for over 30 years. If you are not signed up for the mailing list, click HERE. Will we be turning Japanese? Tune in to find out!

And finally, onto our regular playlist. Have a great bank holiday weekend, stay safe and I shall see you all next week.

The content of the above blog is for information purposes only and does not constitute advice. If you do not understand any of the content, we would recommend that you seek professional advice.