Hasn’t it flown by? The week, that is. It seems like only yesterday that I was penning last week’s Magnum Opus and here I am, concertoing it up once again. That’s not a real word, but please feel free to use it. Anyway, strap in, get that sunscreen on and prepare yo’self for this week’s News, Views and Truths.

Would it be a surprise that this week’s edition is about money? Probably not, but money did catch my eye this week.

Monopoly, the board game that is. We have all played it, some perhaps more than others. We all know someone who’s sly and will put a few dollar bills extra into their skyrocket; we all know someone who just had to be the banker. Was the dog your favourite playing piece? The car? Perhaps the top hat?

Monopoly is the game of capitalism and it can be great fun. Unlike the socialist boardgame which is just a box full of sticks and disappointments, but that’s for another blog…

Monopoly, believe it or not, can also be a window into society. And as society changes, so does Monopoly.

Monopoly is bringing out a cashless version, the digital “voice banking” edition, which keeps track of players’ transactions. No need for a banker. No need for a pile of notes.

No need for a local branch. No need for cash machines. Just tap.

We are moving towards a cashless society. Cash accounts for 3 in 10 transactions, compared with 6 in 10 a decade ago; in 15 years’ time, this is predicted to fall to 1 in 10.

And to hammer this change home, a new app called Giving Streets will soon allow you to donate to homeless people using your mobile phone. Buskers in London and street performers in Edinburgh use contactless payment points for tips. Galleries and museums do the same for donations and so do some churches. Cash is becoming yesterday’s news.

And hence the reason why there is so much hype around crypto currencies. Readers of last week’s blog will remember Facebook’s move into crypto with the announcement of Libra, which resulted in a massive surge across the crypto universes, pushing bitcoin to $14,000, its highest level since January 2018. Crypto is back, it’s the new normal, long live the king.

Until it fell $2,000 overnight. Overnight.

The reason? The same reason as always. The technologies used to conduct crypto transactions are temperamental at best. US exchange Coinbase suffered an outage yesterday and as crypto prices are so sensitive to technical mishaps, the bottom fell out of it. Buyer beware.

So, although monetary transactions are evolving due to technology, cash remains king, even in the new normal of low-interest rates. Let’s be honest, the days of 5% interest rates are long, long gone. But that doesn’t detract from the importance of cash as an asset class.

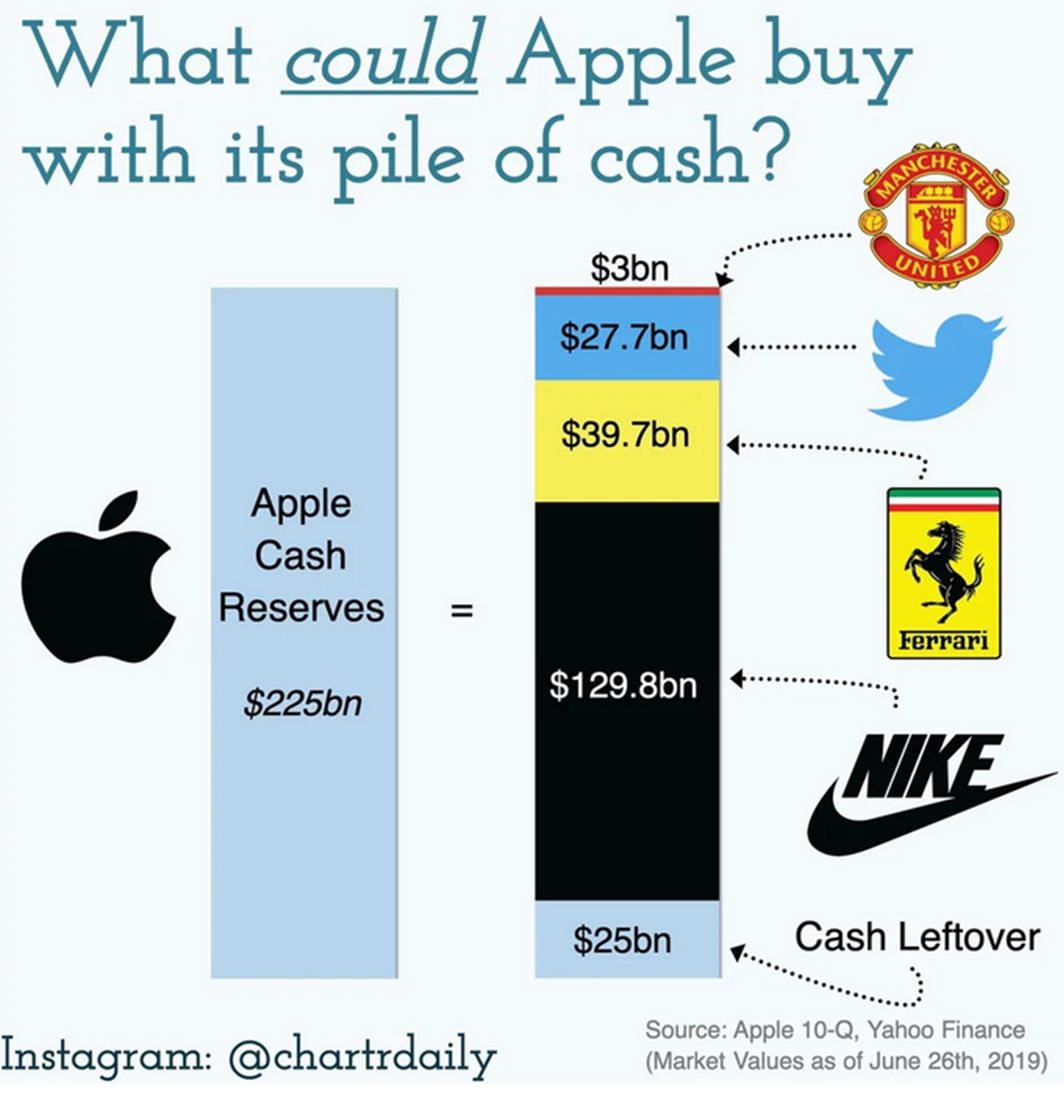

Apple Inc loves cash…

I saw this chart and loved it; perhaps you will love it too. No comment aside from, “Wow, what a lot of cash”.

And as per usual, our playlist. This week with a particular monetary theme. It’s going to be hot this week; please, please, please enjoy yourselves but take it steady. I shall see you all, lobster red, next week!