Hello and welcome to another edition of News, Views and Truths. Genuinely, the most difficult part of all of this, for me, is the opening introduction, so let’s put that to bed and get cracked on.

“It’s a funny old game” – Jimmy Greaves

It is. The market, that is. Last week was all about Black Swans and the downside. This week, it’s all about asset bubbles and melt-ups.

Since Monday, global equity markets have romped away, in stark contrast to last week’s doom and gloom. At the time of writing the FTSE 100 is up 2.31% on the week, with the US S&P 500 5.77% to the positive. Japan has shrugged off the initial concern brought about by the Coronavirus, making 3.37% on the week, with Emerging Markets also delivering a positive 3.39%.

And the reason for this? Again, many commentators are pointing to the underpin provided by Central Banks and their policy of perpetual easing. This has provided the perception of invulnerability, evidenced, some say, by the significant rally in Bitcoin and this publication’s favourite crazy-stock, Tesla. As a point of note for regular readers, Tesla has been up 141% and down 29% in the past 25 trading days…

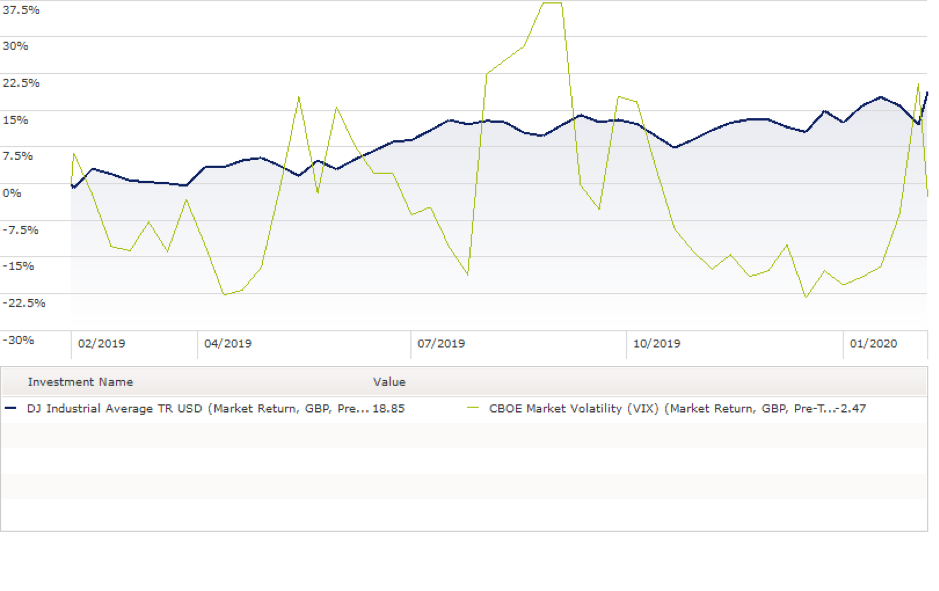

Equity indices are continually hitting new all-time highs, yet the CBOE Volatility Index (VIX), a gauge of investor anxiety, drifts lower.

“Life is a rollercoaster, just gotta ride it” – Ronan Keating

All this while four US companies now have a greater market capitalisation than $1 trillion – Microsoft, Apple, Google and Amazon.

And it’s not just equities. The value of negative-yielding global debt surged $3 trillion to $14 trillion in the past two weeks as a result of the largest flow into bond funds. To put this into perspective, year to date, the inflow has been $981bn versus a record annual inflow of $481bn during 2019. Is there any way NOT to make money at the moment?

Yes. Commodities.

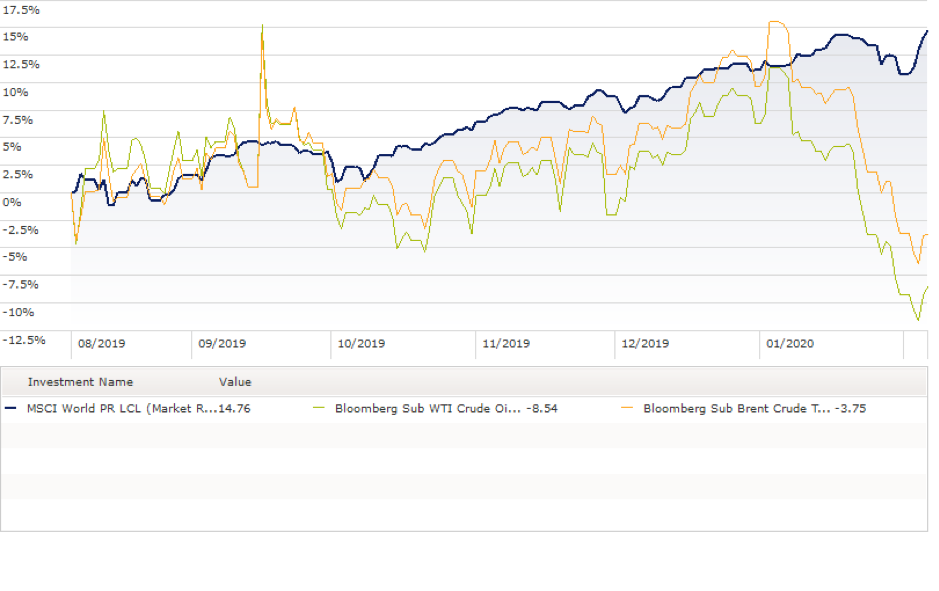

West Texas Intermediate, (the lightest and sweetest crude) has fallen 20% over the past month and has dipped below $50 per barrel. This could have negative effects on near term market returns.

According to hedge fund analytics tool Kensho, a month after similar drops, WTI tends to shed a further 10%. It trades negatively 60% of the time during these periods (five instances in the past decade), which also have been hard on equities. The US S&P 500 has averaged a decline of 1.6% during these one-month trading windows and posts a negative return 60% of the time.

All of this is due to the fear generated by the Coronavirus outbreak and the slump in demand as China continues to be on lockdown.

So, what to take from all this?

“It’s time in the market, not timing the market” – Me

At least I am consistent with my message.

And to conclude, a playlist. I hope you all have a great weekend; take it steady Sunday as the storm hits and I shall see you all next week.