It’s been quite the week and to be honest, today is rather interesting also. Would you expect otherwise? Let me explain in this week’s News, Views and Truths.

The coronavirus, compounded by falling oil prices, exacerbated by growth uncertainty have all hit capital markets with some force this week, sending markets one way.

Or another…

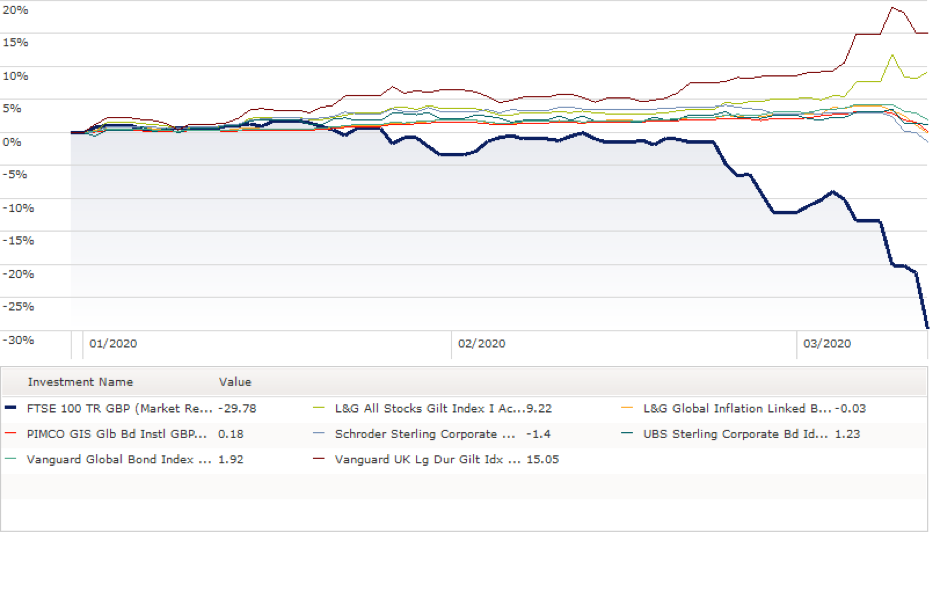

The natural focus has been on equity markets. Thursday saw the biggest fall in the FTSE 100 since 1987, with 10.87% coming off the UK leading companies’ index. Similar falls were felt across the US, with the Dow Jones Industrial Average falling 10%. Year to date, the FTSE 100 is down 29.78%, highlighting the concern across the globe.

However, it’s not all bad news for investors. That is, if you are correctly invested.

As those who have listened to me over the past seven years will know, a properly diversified portfolio, in line with your personal attitude to investment risk, will weather storms. This is a storm; this is a force 10 storm, probably called Storm Wolfgang.

Storm Wolfgang doesn’t like equities. But up to now, likes bonds. Below is a sample of the bond funds we hold within our portfolios, comparing it to the recent performance of the FTSE 100, since the beginning of the year.

Bonds are special souls; you see, not all bonds are the same. Some bonds are super high quality and pay very little in the way of interest, yet react in the opposite direction to equities. Some bonds, however, act in a very similar way to equities and pay you a greater interest, essentially compensating you for the higher potential volatility.

For the most part, during 2019, we favoured the former, high-quality bonds when no one else did. As a result, our portfolios are benefitting from this.

But we never ever rest on our laurels; markets are moving quickly. As I write, equity markets are rebounding sharply on the back of governmental responses. Last night the US announced an injection of $1.5trn to supply liquidity if needed. Yes, trillion. TRILLION. $1,500,000,000,000. Big problems require big solutions.

Further to this, the US Food and Drug Administration (FDA) has today announced that they have approved a new coronavirus test that is ten times quicker at spotting the virus than current tests. The FTSE 100 is up 6.80% and the US Dow Jones is up 4.58%.

We are currently reviewing what this will mean for our portfolios and if needed, will communicate any actions we believe our clients should make. Please be assured that we will act as necessary and that this action will be swift if required.

However, in the meantime, do nothing. The market conditions are a concern, but we have that covered. What I would ask you all to do is take the advice with regards to the coronavirus seriously; we certainly are.

We have held many internal meetings and discussions as to the potential scenarios that could emerge for the business and can assure you that we have taken all necessary steps to ensure the smooth running of both Three Counties and Greaves West & Ayre. I can confirm that when the situation evolves, we will detail these further, but until that point, it is business as usual.

So please take care and if you need anything from us, please ask.

Finally, our playlist. Have a great weekend and I shall see you all next week.