Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Sell-off Resumes

- The global stock market (MSCI World Index) declined 3.9% in September but has risen 12.1% this year

- The bond market (Bloomberg Global Aggregate Index) declined 1.5% in September but remains up 1.1% this year

- Government bond yields rose sharply this month, putting pressure on other asset classes

Key Themes

The first half of 2023 produced good returns from overseas stock markets, as most economies proved more resilient than expected, despite forecasts of a recession at the beginning of the year. As the second half of 2023 progresses, those gains are being given back as higher interest rates and rising oil prices are taking their toll once again.

UK

For the first time since April, UK stocks beat their developed market counterparts with the FTSE 100 rising 2.1% for the month. Surprisingly, the Small Caps index (+1.3%) also flew in the face of the global selloff, but the FTSE 250 mid cap index (-1.1%) and AIM market (-1.8%) continued their declines. This month’s core inflation data produced the biggest downward surprise since the measure began in 2005, at 6.2% versus 6.9% estimated. Market reaction was very positive on the day, but was quickly overwhelmed by global forces. UK unemployment rose to 4.3% for its fourth monthly increase from an initial level of 3.8%. However, annual wage growth is still climbing and has reached 8.5%. Such contradictions are emblematic of the current investment environment, as financial markets try to predict whether negative (bearish) or positive (bullish) forces will prevail.

United States

US stocks went from ‘hero to zero’ as their year-to-date leadership reversed into the largest monthly decline among developed markets. The Nasdaq technology index (-5.8%) and broader S&P 500 index (-5.0%) both suffered from rising interest rates, which triggered a reappraisal of high stock valuations (the UK, of course, has always been cheap). There are a number of negative statistics to support those of a bearish temperament: the Fed estimates that excess Covid savings have now been exhausted, credit card and loan defaults have hit a 10-year high and corporate bankruptcies are rising. Further, 3-month Treasury Bills yield more than the stock market for the first time since 2000, while valuation spreads and index concentration are also at extremes. The top 10 stocks now account for 35% of the entire US stock market by value, which is the highest reading in over 30 years.

Europe

In Europe, Germany continues to lag both economically and through its stock market, which declined -2.9% in September. The German economy has only grown 0.2% in real terms since before the Covid pandemic and the IMF forecasts that it will suffer an outright decline of -0.3% for 2023. The UK economy has grown 1.6% from pre-Covid levels, which is similar to France (1.7%) but below the Eurozone as a whole (2.7%). By comparison, the US has grown 6.1%.

Asia & Emerging Markets

Japanese stocks proved relatively defensive with only a small monthly decline (-0.4%) for the Topix index. Officials in Japan and China felt the need to make public comments in support of their currencies, as the yen and yuan extended their declines versus the US dollar. Warnings against currency speculation come after the Japanese yen has lost 31% of its value versus the dollar since January 2021, with the Chinese yuan losing 9% in the past six months despite attempts at currency control measures.

The MSCI Emerging Markets Index declined in September, but held up quite well relative to other regions (-2.3%). India (+1.1%) remained strong. However, Hong Kong suffered another -5.0% decline to add to the -8.2% fall in August, as sentiment around Chinese real estate investments remained sour.

Bonds

Government bonds are supposed to be the most boring and unexciting of investments, but they consumed the focus of investors around the globe this month as yields spiked markedly higher (prices lower). The benchmark US 10yr Treasury yield moved from 4.11% to 4.72% to reach its highest level since 2007 and cap the biggest 3-month jump since 2009. Other government bond yields are following suit, although UK 10yr Gilts have remained steady and within their recent range, at 4.57%. The market has perhaps taken fright at expectations for over $1trillion in new Treasury issuance during the second half of this year, with increased chatter about the US budget deficit and debt levels.

Points of Interest

Sterling had its worst month versus the dollar (-3.7%) and the euro (-1.3%) since late 2022 after the Bank of England kept interest rates on hold for the first time since November 2021. Dollar strength remains the main theme across currencies.

Demand for dollars is often seen as an indication of tight Financial Conditions, or in other words, poor global liquidity. A decline in liquidity caused by quantitative tightening, higher interest rates and the roll-off of US fiscal stimulus is perhaps the simplest explanation for recent market declines. Remarkably, US citizens only resumed their student loan repayments this month, after a 3-year pause.

A rising dollar is usually a headwind for oil prices but Brent Crude continued rising during September, from $86 to $95 per barrel. Natural Gas prices have also risen slightly as winter approaches. Among precious metals, the safe haven of Gold finally cracked in the face of higher real yields and declined 5%.

Summary

History shows that September tends to be one of the most volatile (and disappointing) months for investors. This year was no different. The dominant market themes have been weakening economic data, high oil prices, a strengthening US dollar and rising bond yields. This is quite close to a toxic combination and harks back to 2022, which was a very poor year. Many traders are hoping that conditions will stabilise and the typical winter rally will ensue. Whether this is blind optimism or not, there are attractive valuations available within many stock markets and high income yields now on offer from bonds, to provide comfort to the patient investor.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

MGTS Qualis Funds Update

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

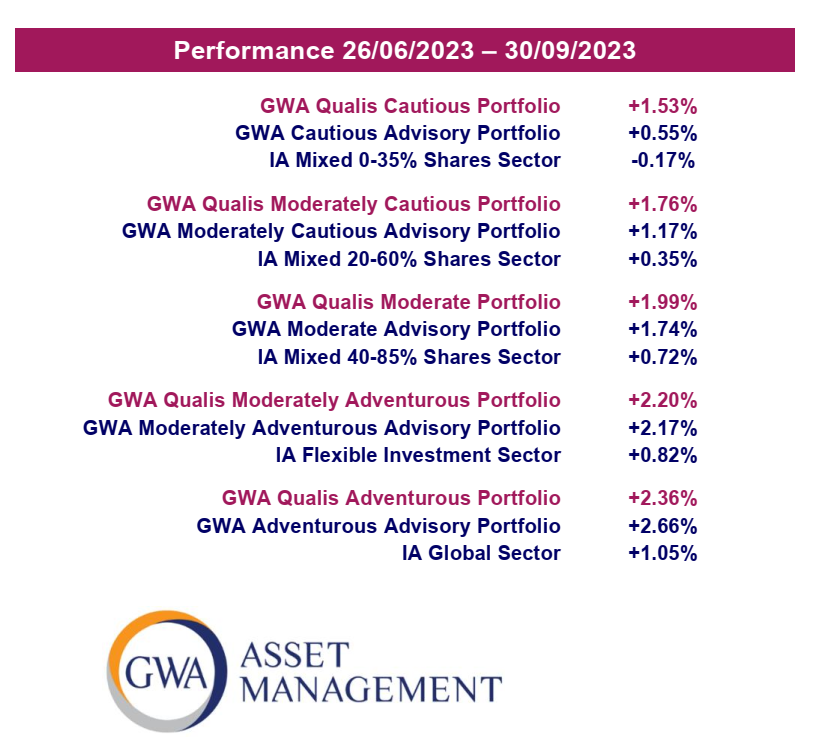

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in commodities and alternative assets. The fund does not hold any equities. The fund is currently focused on seeking a positive return while managing interest rate risk.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund has an overweight position in Japan. The fund recently increased its allocations to the Energy and Healthcare sectors.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk