Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

The End of Rising Rates?

- The global stock market (MSCI World Index) declined 2.9% in October but has risen 9.2% this year

- The bond market (Bloomberg Global Aggregate Index) declined 0.7% in October but remains up 0.4% this year

- Central banks may have finally stopped their interest rate hiking cycles

Key Themes

October was another difficult month for investors – the culmination of three consecutive months where stocks and bonds have declined together. However, the US and UK central banks provided “dovish” statements on November 1st and 2nd, stating policy is adequately restrictive in light of slowing inflation. Markets are now forecasting that further interest rate hikes are highly unlikely and have entered the new month on a positive note.

UK

UK stocks suffered in particular last month, with declines ranging from 3.7% to 6.3% for large-cap stocks and smaller stocks respectively. This placed the UK at the bottom of the developed market leaderboard, as has been typical throughout 2023. The small and mid-cap indices have declined 6% this year, after falling 17% in 2022. AIM has now lost 45% of its value since its peak in September 2021.

AIM is now sitting at the lows of its trading range from the 2010-2017 period, while the FTSE 250 is at 2015 levels. When so many years of growth have been wiped out, it can be a sign that excellent value is on offer. Some investors certainly seem to believe so: the proportion of takeovers by foreign acquirers has increased markedly in recent months, and the FTSE Small-Cap Index has lost 10% of its constituents to takeovers this year alone1.

United States

The S&P 500 has had its biggest downwards move (-11%) since the market bottom in October 2022: greater than the decline in March (-9%) following the US regional banking crisis. Despite that, the main US stock market index remains up 10% for the year. The Nasdaq technology index has risen 24%.

Almost all gains have come from the “Magnificent 7” stocks of Apple, Alphabet (Google), Microsoft, Amazon, Tesla, Nvidia and Meta (Facebook). The other 493 stocks within the S&P 500 are broadly flat for the year. However, in recent weeks many of the Magnificent 7 have produced weak earnings forecasts for 2024. The Magnificent 7 stocks are valued at 28x forward earnings, compared to 16x for the rest of the S&P 5002.

Europe

The Stoxx 600 index declined 3.6% in October but remains up 5.2% year-to-date. Eurozone inflation (2.9%) and GDP growth (-0.1%) came in below expectations3 at the end of the month, in the latest sign of an economic slowdown within the region. The market expects the European Central Bank to begin cutting interest rates in March 2024, earlier than the Bank of England or US Federal Reserve4.

Asia & Emerging Markets

The Japanese Yen’s relentless decline saw it breach the landmark 150 per US Dollar level. The Bank of Japan put up resistance to the move on 3 October, but gave way on the 25th and the Yen is now at its weakest level in 33 years. The Japanese 10-year bond yield is slowly being allowed to rise as the BOJ begins lifting its control measures5, but at 0.90% it remains far below Western peers. It may take higher yields to support the currency. Japanese stocks experienced a bumpy month, but are now back where they started and have gained 5% in Sterling terms this year.

Chinese economic data remains mixed, as investors search for signs of any improvement in the world’s second-largest economy. The Shanghai and Hong Kong stock markets remain down 8.5% for 2023. The Vietnamese market, previously one of the best performers of 2023, slumped by 13% in October as a trading boom ended with volumes declining 37% from the previous month6. The MSCI Emerging Markets Index is flat for the year.

Bonds

The selloff in stock markets over the past three months has been driven by a storm in the government bond market. The yield on 10-year US Treasury bonds peaked at 5.02% on 23 October, having risen from 3.7% on 23 June. Such a surge in the global cost-of-borrowing benchmark sent a shockwave throughout capital markets. Thankfully, that yield has eased to 4.6% following the Federal Reserve Monetary Policy Committee meeting on 1 November. Investors are breathing a sigh of relief, for now. Indeed, several high-profile bond investors – including Bill Ackman, Bill Gross and Jeffrey Gundlach – had already called for an end to rising bond yields7,8. Their logic includes a mix of attractive valuations, recession concerns and the US government’s unwillingness to tolerate higher debt interest payments.

Points of Interest

UK CPI data on 18 October hinted at stickier inflation than expected, with a monthly rise of 0.5%9. The latest inflation and average earnings figures mean UK state benefits are likely to increase by 6.7% next April, with the UK state pension potentially increasing by 8.5% at that time10. The headline year-on-year inflation rate is likely to drop considerably from 6.7% at the next announcement on 15 November, as the 2% monthly inflation figure from October 2022 is removed from the calculation.

The number of firms in critical financial distress jumped 25% in the last three months, with 6,208 company insolvencies in England & Wales – a similar number to the depths of the financial crisis in 200911. The Bank of England has revised down its growth expectations for 2024, from modest growth to zero growth12. Unemployment ticked up again, by 0.2% last month13. However, wage growth remains robust and is forecast to stay above 5% well into 202414.

UK house prices rose 0.9% in October, in a surprise move15. Expectations were for a 0.4% fall16. However, transaction volumes remain low. Likewise, across the pond fewer Americans are applying for mortgages than at any time since 1997, with the number of US housing transactions at similar levels to 2009, during the sub-prime mortgage collapse17. Echoes to 2009 hint at the level of economic pain beneath the headlines.

Summary

After three months which resembled the relentless declines experienced in 2022, investors are rejoicing at the prospect that interest rates might finally have peaked. There has been widespread talk of a traditional year-end rally, with November and December providing the strongest average returns over any two-month period in recent years18. However, many analysts are warning of increased recession risk in 2024. For now, the key economic indicators could prove not too hot, nor too cold, but just about right for investors to feel comfortable.

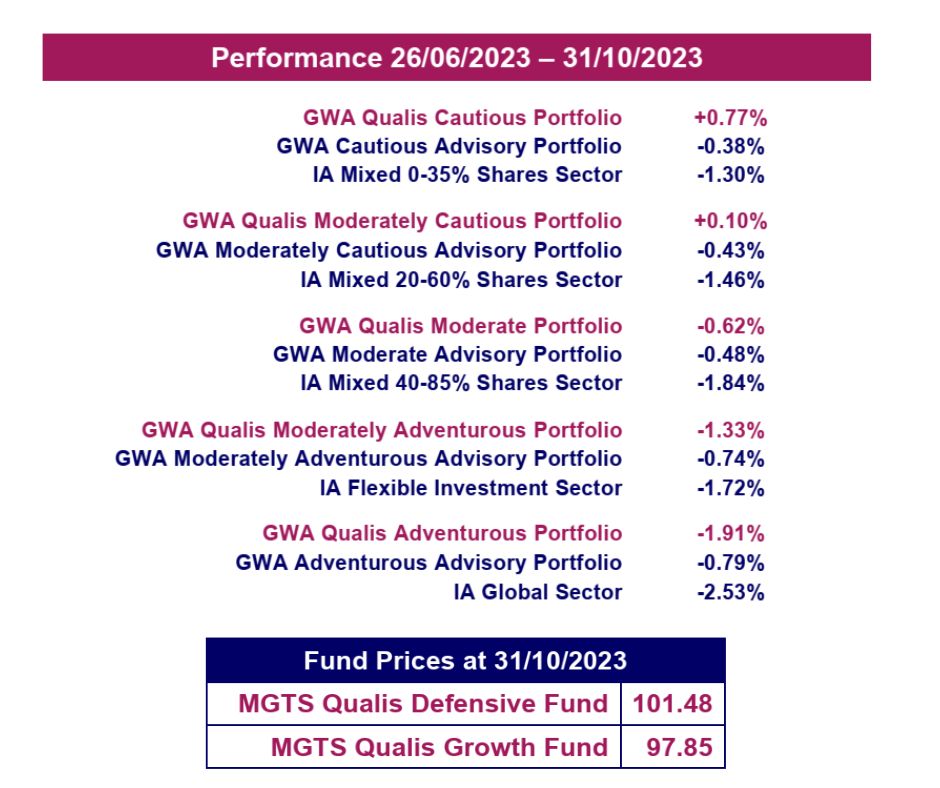

MGTS Qualis Funds

Note: Past Performance Is Not A Reliable Indicator Of Future Performance Sources may be found online at: greaveswestayre.co.uk/global-market-commentary-october-2023

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in commodities and alternative assets. The fund does not hold any equities. The fund is currently focused on seeking a positive return while managing interest rate risk.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund has an overweight position in Japan. The fund recently reduced its Emerging Markets exposure and invested in the Defence sector and broader US indices. For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk