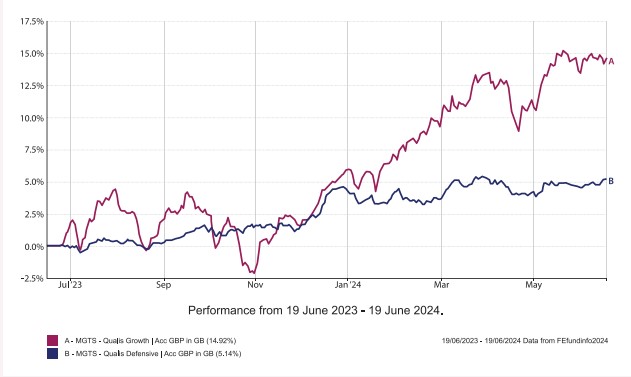

It is now more than 12 months since the launch of the MGTS Qualis Funds and in terms of both performance and asset growth, they have been a success.

Launched on the 26th of June 2023, with the first price being the following day, MGTS Qualis Growth funds has returned 15.85%, with MGTS Qualis Defensive returning 6.05%. MGTS Qualis Growth is currently £174.6m in size, with MGTS Qualis Defensive being £105.3m

They are, as illustrated in the chart above, very different animals. MGTS Qualis Growth is 100% company stocks, diversified globally. MGTS Qualis Defensive on the other hand invests solely in those assets that diversify away from the volatility in stocks, i.e cash, bonds and other alternative investments such as hedge funds and property.

As all clients who invest in the MGTS Qualis Funds hold both MGTS Qualis Growth and MGTS Qualis Defensive, it is of vital importance that their two funds are managed independently of one another to ensure performance diversification.

Since the launch, the global investment markets have been wrestling with the impacts of inflation and the tools that central banks have at their disposal to counter this, namely interest rates. That chapter of global monetary policy, for most of the world, is now in the rear-view mirror and as such, focus returns to growth; the lack of this and how to create it.

With interest rate cuts seemingly imminent, we have been positioning both funds to take advantage of this. In MGTS Qualis Growth, we have been steadily increasing our allocation to smaller company stocks who, by their smaller size, are more reliant upon funding to generate company expansion. In the event of interest rate cuts, we believe that they are well positioned to take advantage of this and expect this positivity to be reflected in an increasing share price.

Within MGTS Qualis Defensive, we have begun to increase our allocation to government bonds which have over recent months been one of the most volatile areas of the market. However, with interest rate cuts ever more likely, we believe that this is the time to start adding volatility into the portfolio to capture increased bond returns as interest rates fall.

Once again, we are very pleased with both the growth within the funds and the performance of each of them. As with everything in the investment markets, that is in the rear-view mirror. What is important is what will be, and the continued research undertaken to understand this.

We do see continued opportunities for varied sources of investment returns across both of our funds, but this is not without volatility. However, we do firmly believe that we can continue to generate expected returns through both our focus on diversification and high conviction across all our allocations.