Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Bond Markets Flash Amber

- Stock markets (MSCI World Index) were broadly flat in October and have gained 18% in 2024

- Bond markets (Bloomberg Global Aggregate Index) declined 3.6% in October, eliminating their year-to-date gains

Key Themes

The cost of borrowing has risen sharply in the past few weeks for the UK and US governments. This has caused stock markets to pause for breath after making strong gains. The risk of recession appears low and inflation is currently under control, but it seems as though bond investors need to decide whether the spending plans of politicians have been overdone and if a higher cost may need to be paid, to fund them. At a more micro level, many companies are facing their own cost increases which threaten to weaken profitability in the short term.

UK

Selling activity reached a crescendo in the run-up to the Labour government’ first budget announcement, with net redemptions from investment funds reaching a new one-month record of £2.7bn in October,1 as investors were keen to book capital gains at a lower tax rate. There were also significant withdrawals from pensions, due to concerns that tax-free cash payments may be limited or removed,2 which thankfully did not come to pass.

Tellingly, sell orders dropped by 40% on the day after the budget.3 The AIM 100 Index also gained 4% as the inheritance tax relief on AIM shares was only reduced, rather than removed. On a fundamental level, UK stocks have struggled to make gains since the summer election, with profit warnings hitting a two-year high primarily due to contract cancellations and weak sales.4 Many sectors will see profit margins further pressured by higher national insurance costs, although some comfort should be provided by the Bank of England, who are expected to cut interest rates at least once before Christmas.

United States

The S&P 500 index rose steadily for most of October, before a sharp 2% decline on the last day of the month gave back all of those gains. Facebook fell 4%, with Microsoft down 6%, as both firms warned that spending on Artificial Intelligence (AI) technology would increase greatly in 2025. Investors’ focus often switches between excitement over AI developments and concerns about achieving an acceptable return on investment, and this is another such example. Nevertheless, many Artificial Intelligence ETFs have risen by 30% in the past year, with semiconductor stocks also achieving large gains.

Europe

The EuroStoxx 50 index declined in October but is up a respectable 10% so far this year. Spanish and Italian stocks have fared best, up 18% and 14% respectively, in contrast to the French CAC 40 index which has lost 2% amidst political gridlock and a stagnant economy. With Germany also narrowly avoiding a recession in the third quarter,5 Europe’s traditional Franco-German growth engine is seemingly reliant on further interest rate cuts and a long-awaited recovery in global manufacturing, before it can spring back to life.

Asia & Emerging Markets

Asian stocks gave back some gains in October, following strong rises the previous month which were fuelled by Chinese stimulus measures. The MSCI Emerging Markets Index, which also includes nations in South America and other regions, declined by 3%.

There was a snap election in Japan on 27 October, which saw the ruling party lose its parliamentary majority for the first time in 15 years.6 This led to sharp declines in the Yen and a brief rally for Japanese stocks, which have been very sensitive to the foreign exchange rate recently. It remains to be seen whether the Chinese stimulus measures can underpin further gains across the region, into year end.

Bonds

Government bond yields have been rising again, and at a sharp rate. The annualised yield-to-maturity on a 10-year UK Gilt has increased from 3.75% to 4.50% between 17 September and 4 November. As capital values move inversely to the yield, this has created capital losses of over 4% – wiping out one year’s worth of expected returns. US Treasury yields have also been rising, as markets focus on budget deficits and high levels of government borrowing on both sides of the Atlantic. If interest rate cuts are unable to arrest the rise in bond yields, the effect may soon be felt on the residential mortgage market.

Points of Interest

Gold continues to march higher: now trading at $2,743 per ounce and gaining 38% in the past year. The world’s oldest “inflation hedge” has fared well versus fiat currencies. Indeed, many analysts characterise gold’s gains as being a function of broad monetary debasement, of the dollar and other major currencies, in a time of high inflation and high debt levels. Intriguingly, central banks were also buying the precious metal at a record rate, earlier this year.7

Summary

After a period where investors were focused on Japan and China, political events in the west are now, once again, the centre of attention. Government deficits are coming into focus following the UK budget and US presidential election. Bond investors are beginning to place more scrutiny on spending plans and demand a higher interest yield for providing funding. This threatens to increase the cost of capital across the wider economy, creating less scope for mortgage rates to fall and placing a potential cap on the property market. If all goes well, politicians will appease the bond market and capital will be allowed to move freely and cheaply. With interest rate cuts on the horizon, inflation moderating and economic growth holding up, the ingredients remain in place for positive investment returns in the coming months, all else equal.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online at here or provided on request.

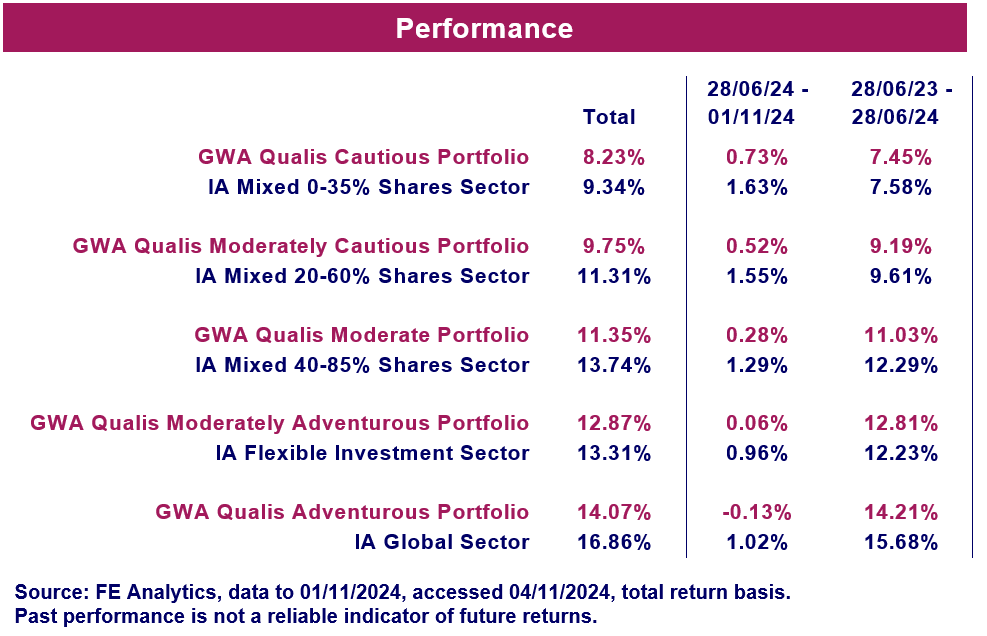

MGTS Qualis Funds

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk