In what was a poor year for investors, the fourth quarter saw gains for stock markets led by Asian and European markets. Government bond yields increased, meaning their prices fell, as central banks reaffirmed their commitment to tightening monetary policy, even though inflation showed signs of peaking.

Overview:

- Q4 saw stocks rally, diminishing the overall decline for the year

- the recent 40-year high inflation rates showed signs of peaking

- bonds rallied in spite of the Fed increasing interest rates

The theme of value stocks outperforming growth stocks that we saw earlier in 2022 continued over the last quarter of the year. Despite this rotation, growth stocks closed the year still relatively expensive by historic standards, and value shares comparatively cheap.

As equity investing is by its nature uncertain and volatile, some poor periods are to be expected. However, the simultaneous decline in fixed interest markets over the year, most notably in traditionally low-risk sovereign debt (government bonds), combined with equities being so lacklustre was a bitter pill for multi-asset investors to swallow.

Most conventional portfolios contain stocks and bonds, the idea being that high quality bonds can provide some protection against equity market slumps. The deterioration of this correlation between the asset classes resulted in the worst year for the traditional 60/40 (equities/bonds) portfolio since the 1930s.

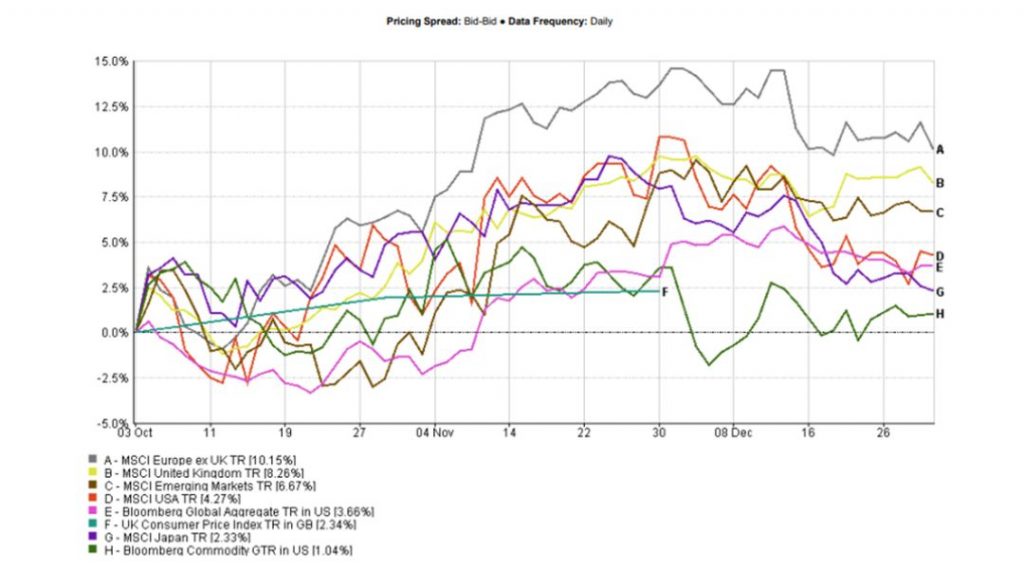

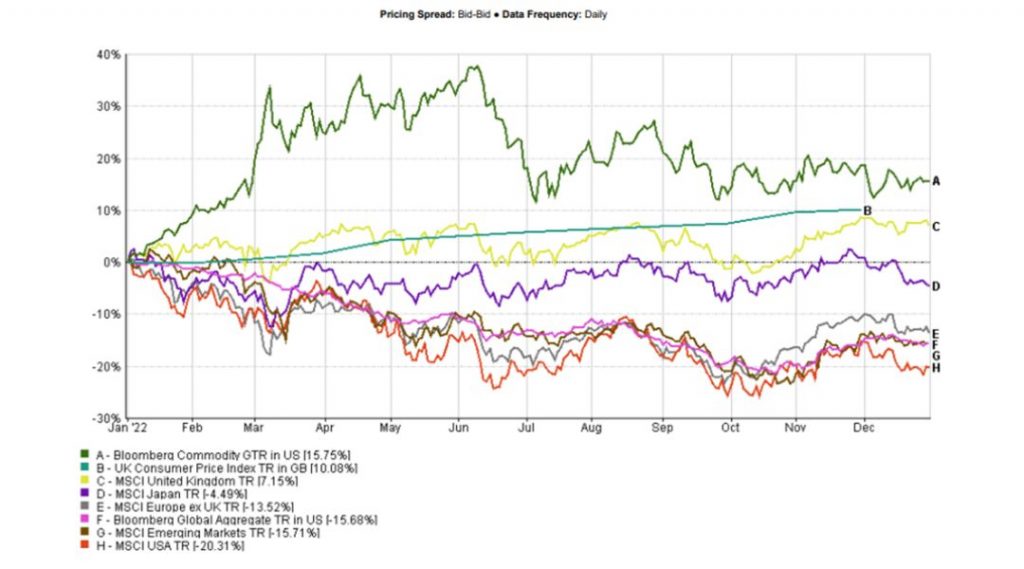

A summary of the performances of major global indices over the fourth quarter and calendar year are provided below:

Market Performance Q4 2022

Source: FE Analytics (03/10/2022 – 30/12/2022), total returns quoted in local currency terms.

Past performance is not a guide of future returns.

Market Performance 2022 Calendar Year

Source: FE Analytics (03/01/2022 – 30/12/2022), total returns quoted in local currency terms.

Past performance is not a guide of future returns.

UK

The UK stock market performed strongly over the calendar year and quarter, aided by its exposure to commodity producers, defensive consumer staples and relatively minor technology content. Q4 gains were no doubt given a boost by the easing of September’s political uncertainty.

A lower sterling exchange rate also assisted returns owed to around three quarters of the FTSE’s revenue originating overseas. This lower sterling rate also helped to reduce losses from overseas markets once they were translated to GBP terms.

However, returns from the UK market were not all good. The domestically focussed FTSE 250 (mid-cap) index was affected by the concerns of economic downturn, falling around -17% over the year. In Q4 however, it did return +10% following a trough of -27% in mid-October.

United States

US equities also performed well over Q4 as investors weighed the US Federal Reserve’s continued caution with signs of inflation peaking and the potential for a slower rate of policy tightening. Strong corporate earnings in select sectors boosted returns, along with better than expected GDP growth.

Europe

Eurozone markets outperformed other regions over Q4, led by gains in economically sensitive sectors such as energy, industrials and financials. Markets were buoyed by the hope of inflation reaching its peak and the European Central Bank (ECB) increasing policy rates by just 0.5% rather than the 0.75% hikes it had previously undertaken. The bank’s president was however at pains to point out that the ECB was likely to increase rates further.

Emerging markets

Emerging market equities also achieved strong returns in Q4, aided by the weakening US dollar. Returns in the early part of the quarter were led by optimism that the US Federal Reserve’s tightening regime may not be as drastic as initially expected, and in turn the economic recession not as deep. This optimism waned in December as the Fed reaffirmed its stance on combatting inflation.

Chinese authorities relaxing the nation’s zero COVID policy earlier and more widely than expected providing greater confidence that we would see the country begin fully reopening for business. As a result, China saw good returns for Q4. However, with increasing reports of COVID-related deaths being on the rise the longevity of this performance should remain on investors radars.

Summary

In summary, whilst the final quarter of 2022 provided some relief it will, on the whole, not be fondly remembered by investors. The consequences of high inflation and interest rates are likely to continue to impact the global economy in 2023. But with a recession generally expected and signs of inflation peaking, the outlook for stocks and bonds in the new year seems improved. If we’ve learnt lessons from the past few years, one must be that we definitely can’t predict what’s around the corner. But we have also learnt that those investors who have stayed the course with a well thought out plan can withstand periods of market volatility and benefit in the long run.

Please note that the content of this review should not be considered investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.