Friday is well and truly amongst us, which means one thing; welcome to this week’s News, Views and Truths.

It’s been quite the week for markets, or shall I say Central Banks. But they drive the markets these days, so it’s basically one and the same thing.

The prospect of a “second wave” of Coronavirus infections kicked everything off and sent the powers that be into a tail spin.

New Coronavirus infections have soared to record highs in six American states, marking a rising tide of cases for a second consecutive week as authorities in Beijing said another 31 people had been infected in a fresh outbreak in China.

Arizona, Florida, Oklahoma, Oregon and Texas all reported their most ever new cases on Tuesday after all-time highs last week, as they continued to reopen their economies. Nevada also reported its highest single-day tally of new cases on Tuesday, up from a previous high on 23 May.

The United States then doubled down on its recent criticism of China when Secretary of State Mike Pompeo, an outspoken critic of China, urged greater transparency during talks on Wednesday in Hawaii with senior Chinese official Yang Jiechi. Calling for neutral observers to assess the extent of the outbreak, David Stilwell, the top US diplomat for East Asia said “I would hope that their numbers and their reporting are more accurate than what we saw in the case of Wuhan and other places in the Peoples Republic of China, but that remains to be seen.”

And due to all of this, like a keenly drilled display team, the global Central banks acted in unison; if it wasn’t for the fact that they are blatantly trying to manipulate the market, I would applaud their heads of communication.

The US Federal reserve kicked it off on Tuesday when it announced that it has started buying corporate bonds as part of a $250 billion program, which was approved back in March. The idea is to backstop corporations and their employees.

When a company wants to borrow money, it can issue bonds. The buyers of those bonds are lending those companies money. Now the Fed is going to buy a broad cross-section of corporate bonds via Exchange Traded Funds (ETFs); a collective fund that tracks an index without any manager applying discretion to the investments that the fund buys. However, on Wednesday, the Fed Chairman Jerome Powell confirmed that the use of ETFs will be limited and that the bulk of this programme will purchase bonds of individual companies, targeted by the Fed.

The question is, what is the target? I’d assume that it would be those companies is trouble; that need the bond purchases the most. That being the case, is this not the transfer of risk from Wall Street to Main Street?

Anyway, moving on…

Closer to home the Bank of England has announced more economic stimulus: it is expanding its bond-buying programme, known as quantitative easing, by a further £100bn to help Britain’s economy get through this economic downturn, taking the total programme to £745bn. They also voted to keep interest rates unchanged at 0.1%, refuting the temptation to turn rates negative.

And then to top it all, the European Central Bank opened its vaults, once again, to European Banks. Banks rushed to borrow a record €1.3tn from the ECB at -1.0%, providing they meet certain lending requirements.

It is the first time that a major central bank has offered multiyear loans to banks at an interest rate below its main deposit rate, introducing a so-called dual-rate system. The ECB said on Thursday that 742 banks had applied to borrow €1.31tn under its main refinancing scheme, which will lend them money over three years at low rates, highlighting the rather desperate economic state of parts of the European Union.

Despite the increase of Coronavirus cases, the market has risen over the week, due to the backstop offered by Central Banks. The FTSE 100 started the week at 6105.18 and at the time of writing is up 1.96% over the week. The US S&P 500 continues its inexorable climb with a weekly return so far of 4.06%.

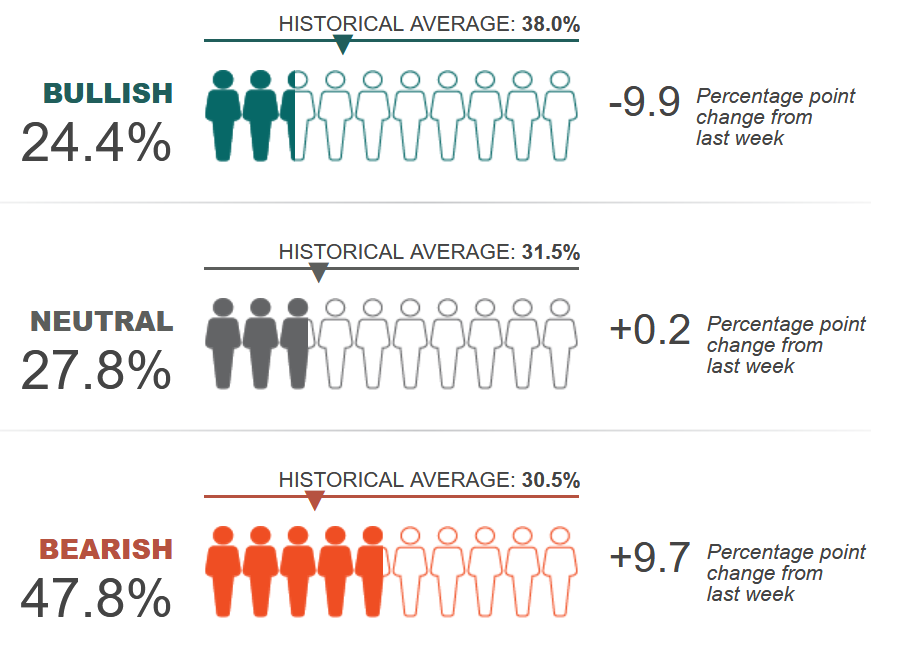

However, sentiment may be changing. The American Association of Individual Investors (AAII) publish a sentiment survey every week and this week showed a discernible swing to the negative. Have markets run too far?

Source: American Association of Individual Investor

Tune in next week to find out!

My weekly podcast is available each week here https://anchor.fm/newsviewsandtruths. It covers my usual market commentary, along with guest contributors who discuss other areas of finance and it would be fantastic if you could give it a listen.

My latest “When Andrew met…” video is live here https://three-counties.co.uk/when-andrew-met-pimco-global-bond/ where I talk to Tina Adatia, Fixed Income specialist at PIMCO and member of the PIMCO Global Bond fund team.

And finally, our playlist. Have a great and safe weekend and I shall see you all next week!