The sun sets and rises again. It’s Friday and you are reading News, Views and Truths – some things never change.

I left you all last week looking down the barrel of one of the most savage market falls history has ever seen. Uncertainty reigned, both within the social and economic sphere. It felt like there was no ability to stop the rout. It felt like there was no slowing the inexorable decline of global indices.

Until it stopped. And then went the other way.

This week has seen some of the biggest gains in global equity markets since 1938. I mentioned last week the possibility of a “quicker than average rebound”; I was not expecting 3 days!

The FTSE 100 opened at 5190.78 on Monday, quickly falling to 4945.16 around lunchtime. Then due to the anticipation and eventual fulfilment of governmental economic stimulation, the market closed yesterday at 5815.73, a 17.60% gain on the week. This was repeated across the globe as stimulus packages were announced with the sole intention to provide an economic backstop, ensuring that once the Coronavirus spread is under control, the foundations of normality will remain.

Those of you that are either regular readers of this blog, or who have spoken to me in person over the past seven years, or both, will know that I have two key investment mantras.

- It is time in the market and not timing the market

- The best days follow the worst days

The latter has been proved to be absolutely correct. Again. But now let’s look at the former.

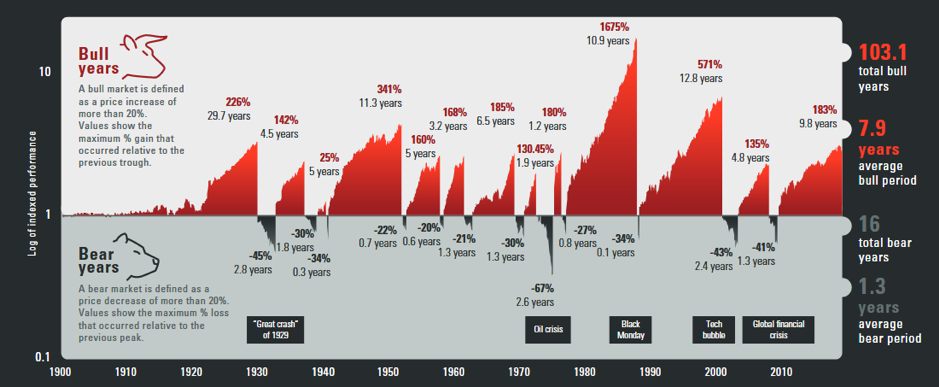

Vanguard, the global asset manager who manages certain allocations of our client investment portfolios, sent me this chart above; bull markets and bear markets.

The best days do follow the worst days and that is irrefutable. But the best investment periods follow the worst investment periods and those are so much bigger and longer in duration than the worst. That is a fact, not opinion. Look at the chart.

The current market is dominated by one constant; speed. After falling into a bear market at the fastest rate ever, the S&P 500 just recorded its quickest three-day advance since the 1930s. As absurd as it may seem, the Dow Jones Index has already started entering a fresh bull market, up 20% from its lows and adding more than $2trillion in value to the market.

Is this a bear market bounce? Is it more sustainable? No one knows. No one can honestly predict the ramifications of the Coronavirus pandemic and there is nothing in history to compare it to. On the flip side, there has never been this level of economic stimulus flooding the market; with literally trillions of dollars and pounds being injected, there is the case for buying the dip.

It cannot be stated enough; no precedent exists for this current situation. For every optimist who says we are witnessing the start of something real, there is a pessimist to remind you that the largest stock rallies happen in bear markets. Maybe we need complete and utter capitulation; maybe we need for all hope to be lost?

But we do know that the best times always follow the worst. And in these most challenging of times, that is a piece of positivity that we all should hold on to.

Before I wrap up for another week, you should all know by now that Three Counties are working from home. This, however, does not alter anything in terms of the service or the work that we conduct for all our clients on a day to day basis. We are all contactable in exactly the same way as before; all post is getting opened and processed on a daily basis as usual and if anyone wishes to talk to any of us, just call the office on our usual number 0191 230 2034.

If you are not lucky enough to be invested into a Three Counties investment portfolio, which have weathered the storm significantly better than our peers, we are always here to talk. It may feel like the world is grinding to a halt, but remember, money never sleeps.

And so to our usual playlist; please take care, keep positive and I will see you all next week.