Hello; there is a lot going on at the moment, so let’s get cracked on. Welcome to this week’s News, Views and Truths.

The Coronavirus continues to dominate the airways and the markets; after a strong opening to the week, equity markets have oscillated with wild swings both up and down. The UK FTSE 100 is currently down 1.19% for the week, with the US S&P 500 up 1.65%.

Yet it is the bond markets that are generating the most attention.

I have written about bond performance in previous blogs, however the moves in yield this week have been some of the most significant in history.

Global bond yields: pic.twitter.com/CzTF9k8NrC

— RANsquawk (@RANsquawk) March 6, 2020

The yield on 10-year UK and US bonds have hit their lowest point today, at 0.246% and 0.695% respectively as a result of the soaring demand for risk-off assets. Neil Wilson, Chief Market Analyst at Markets.com summed the situation up quite neatly:

“The bond market is scaring the raccoons out of the air ducts like crazy right now. Investors seeking shelter and betting on aggressive policy cuts have driven the hottest bond rally in years, if not ever.”

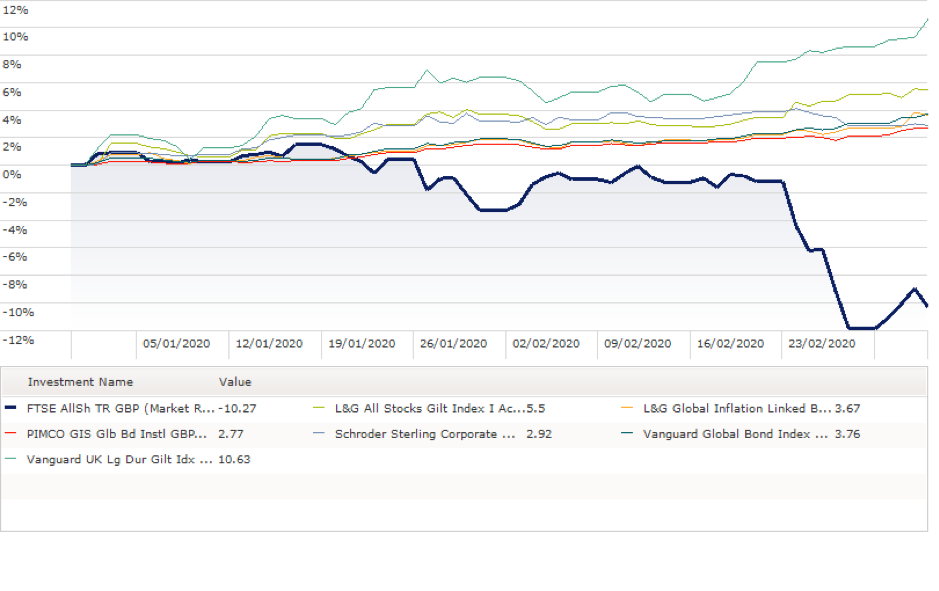

Remember, when yields go down, the price goes up. So, although investors have been losing value on the back of equity market falls, if they have a diversified portfolio, they have been benefitting from the returns on their fixed income allocation. To illustrate this, the chart below shows the FTSE All Share index this year, along with the fixed income funds held within Three Counties’ investment portfolios:

Investing is not supposed to be easy; it has certainly been easy over recent years, yet this current volatility is essentially moving back to expectation. However, keep in mind that, unlike 2008, diversification is currently working. If your portfolio is diversified sufficiently, in line with your agreed risk tolerance, then I would suggest that you have very little to be concerned about.

Remember, as classically illustrated through this week’s market performance, the worst days performance is closely followed by the best days; to miss one will inevitably lead to missing the other. All that disinvesting will achieve is a significant detraction in long term growth.

And it would not be one of my tirades without the classic…

And to finish, our usual playlist. Keep safe, keep sane and wash those hands!

I shall see you all next week.